- Not FCA Regulated

GO Markets, founded in 2006, has cemented its status as a leading broker in the Internet trading industry. Originating in Australia, the firm has grown its worldwide reach to include offices in important financial cities such as Hong Kong, Taipei, and the UK.

Since its founding, GO Markets has focused on regulatory compliance, obtaining certification from prestigious organizations like ASIC, FSA Seychelles, FSC Mauritius, and CySEC.

Traders like GO Markets because of its constant dedication to protecting money and respecting industry standards. Rigorous verification measures build customer trust, guaranteeing their financial security meets worldwide market standards.

The company’s ability to execute orders quickly and support a variety of trading tactics, from scalping to hedging using Expert Advisors, appeals to a wide range of traders.

GO Markets Feature

| 🔎Feature | 🥇 GO Markets |

| Established Year | 2006 |

| Regulation and Licenses | ASIC, FSA Seychelles, FSC Mauritius, CySEC |

| Ease of Use Rating | 4/5 |

| Bonuses | None |

| Support Hours | 24/5 |

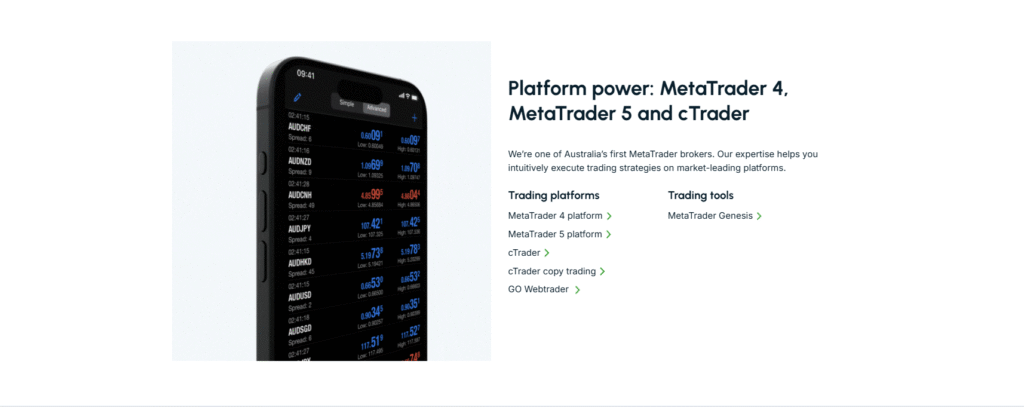

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader |

| Account Types | Standard, GO+ Plus |

| Base Currencies | AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF, HKD |

| Spreads | From 0.0 pips |

| Leverage | 1:500 |

| Currency Pairs | 50+; minor, major, exotic pairs |

| Minimum Deposit | 200 USD |

| Inactivity Fee | None |

| Website Languages | English, Spanish, Italian, Portuguese, Arabic, Indonesian, Thai |

| Fees and Commissions | Spreads from 0.0 pips, commissions from $2.50 |

| Affiliate Program | ✅Yes |

| Scalping | ✅Yes |

| Hedging | ✅Yes |

| Trading Instruments | Forex, shares, indices, metals, commodities, cryptocurrencies |

Security Measures

The safety and confidence of GO Markets’ clients are paramount, evidenced by its employment of a comprehensive suite of security protocols to safeguard client data and assets.

The brokerage is stringently regulated by reputable institutions such as ASIC, FSA Seychelles, FSC Mauritius, and CySEC, which enforce strict financial regulations. Client funds remain separate from operational assets in segregated accounts, with top-tier banks protecting against potential misuse or abuse.

GO Markets uses advanced encryption technologies to enhance online security and protect data transfers over the internet from unauthorized access. Additionally, client accounts are protected by two-factor authentication (2FA), which requires a second form of verification before granting access to trading platforms or account management features. Only the rightful owner can modify settings or execute trades on their account.

The commitment of GO Markets to safeguard the confidentiality and security of customer information is evident in its robust privacy policy that delineates the collection, usage, and protection procedures.

Essentially, by adhering stringently to various regulatory requirements and deploying state-of-the-art technology systems, financial safeguards, and stringent data privacy standards, GO markets deliver a secure trading haven for customers at all times.

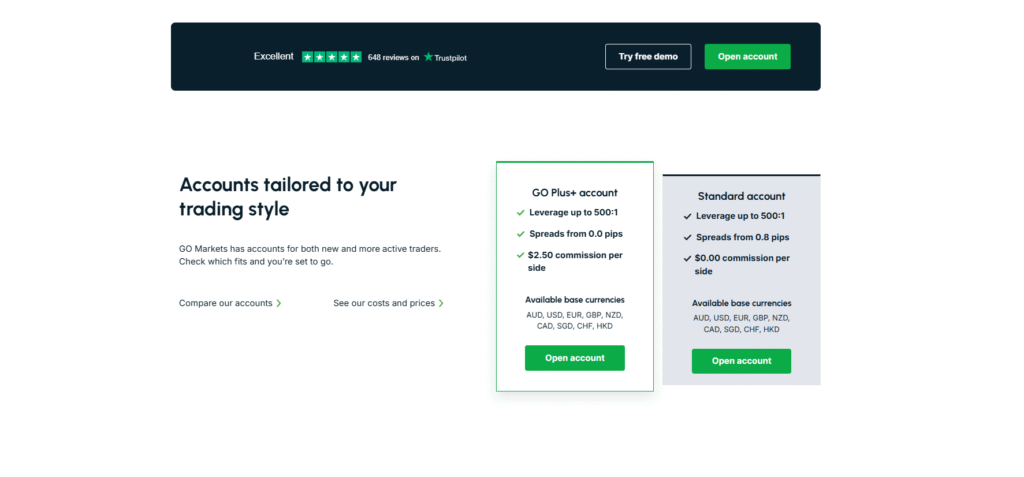

Standard Account

New traders can begin their trading journey with GO Markets’ Standard account, which offers an ideal starting point. This requires a minimum deposit of $200 and provides commission-free trading with flexible spreads beginning at 1 pip.

It combines liquidity from numerous sources to furnish a diversified trading ambiance for users wishing to access over 50 currency pairings, indices, commodities, along many other choices available through leveraging up to 1:500.

Furthermore, this account permits the implementation of automated Expert Advisors while giving participants easy entry into training materials. It enables effortless navigation in case anyone is unfamiliar or new within markets, making it perfect for such individuals.

GO+ Plus Account

Experienced traders can opt for the GO+ Plus account, which mandates a minimum investment of $200.

This account type boasts raw spreads starting at 0.0 pips. It charges AU$ 3 per side on an average lot, making it ideal for high-volume trading activities like scalping or day trading that benefit from narrower spreads and quicker executions.

With access to identical markets and leverage as the Standard account, individuals seeking a competitive edge in fast-paced financial environments will find GO+ Plus suitable for their needs.

Demo Account

GO Markets provides a Demo account that emulates the trading conditions of genuine accounts, furnishing traders with an opportunity to rehearse and enhance their strategies in a secure setting.The demo account facilitates familiarity with either MetaTrader 4 or 5 interfaces and permits the evaluation of brokerage products.

Furthermore, the GO Markets demo account is active for thirty days, offering prospective clients ample time to comprehend platform dynamics and functionalities before considering actual financial investments.

Islamic Account

GO Markets offers a Swap Free Trading Account, also known as an Islamic Account, for traders who cannot pay or receive swaps due to religious beliefs or other reasons. This specialized account allows traders to access the full suite of trading services without incurring interest charges.

Instead of swaps, a standard daily administration fee is applied to cover expenses associated with managing the account. This fee structure allows traders to participate in the financial markets while adhering to their religious or personal preferences.

The Swap Free Account offers access to over 1000 instruments, including Forex, Cryptocurrency, Indices, and Commodity CFDs, allowing traders to diversify their portfolios and explore various trading opportunities.

The account is compatible with GO Markets’ MetaTrader 4 platforms, ensuring seamless integration and efficient trading execution.

GO Markets emphasizes providing high-quality infrastructure, fast execution speeds, and transparent, secure, and reliable services to all traders. In addition, a complimentary 11-day trial period is available for traders interested in trying out the Swap Free Account.

Professional Account

The specialist Professional account offered by GO Markets targets experienced traders who meet specific criteria about their trading volume, industry expertise, and investment track record.

This package offers added capabilities and exclusive support services for advanced resources, further enhancing the trader’s existing abilities and know-how.

Eligibility conditions entail a substantial monetary portfolio or an extensive history of recurrent high-capacity trade-related operations.

Trading Platforms and Software

MetaTrader 4

GO Markets MT4 is a popular trading platform well-known for its powerful functionality and user-friendly interface.

This feature-rich software includes advanced charting tools, automated trading through Expert Advisors (EAs), and an extensive back-testing environment that helps traders customize their forex and CFD trades using various technical indicators and graphical items.

In addition to these features provided by the standard version of MT4, GO Markets offers additional tools designed to enhance trade execution efficiency as well as analytical capabilities – making it easier than ever before for both novice or experienced traders alike looking for a dependable yet adaptable environment in which they can thrive.

MetaTrader 5

With its advanced features and capabilities, such as extended periods, integrated economic calendars, improved pending orders, and enhanced EA strategy testers, GO Markets’ MT5 offers a more empowered trading environment than ever.

By embracing this technology platform, the company reinforces its commitment to providing traders with state-of-the-art tools. The upgraded charting technology and an extensive collection of indicators support sophisticated analytical demands for greater trade flexibility.

For those looking to diversify their portfolio across multiple markets, including commodities, equity, and currency options, GO Markets’ MT5 provides all-encompassing solutions at one location.

cTrader

Designed for traders who prioritize quick execution and distinctive trading features, cTrader by GO Markets offers a user-friendly interface, advanced charting tools, and level II pricing that reveals complete market depth for increased transparency.

A standout feature of this platform is its algorithmic trading capabilities that allow traders to build and operate custom trading robots. Additionally, cTrader’s modern design and compatibility with various devices make it an appealing choice for those seeking efficiency through smart technology.

With assurance from GO Markets regarding fast order entry without requotes—a particular benefit to scalpers or day traders—cTrader stands out as an exceptional option in online trading platforms.

Fees, Spreads, and, Commissions

Spreads

GO Markets’ spreads aim to cater to diverse trading approaches and techniques, providing them with an edge in the market. The Standard account commences at 1 pip for its spreads, enabling traders to carry out transactions without charges.

Boosting this benefit further is the GO Plus+ account that presents a raw spread as low as 0 pips – ideal for strategies necessitating narrow margins.

These variable ranges stem from over twenty-two liquidity providers pool, ensuring clientele access premium bid and ask rates leading towards cost-efficient deals on their behalf via the GO Markets platform.

Commissions

At GO Markets, commissions are tailored to suit the trader’s account preferences. For Standard accounts, there is no commission charged, but instead wider spreads that include transaction fees.

But for those using the GO Plus+ account with narrower spreads, AU$ 3.00 per side for a regular lot is required as commission if their base currency is Australian dollars (or corresponding fees in other currencies).

This clear-cut structure empowers traders by providing better control and transparency over trading costs, allowing them to calculate potential earnings or losses easily.

Deposit and Withdrawal Fees

At GO Markets, transparency is a top priority regarding deposit and withdrawal costs. Regardless of your chosen method, we do not charge any fees for these transactions, whether credit cards, e-wallets, or bank wire transfers.

This means traders can manage their assets efficiently without worrying about unexpected expenses eating into their trading capital.

Educational Resources

GO Markets offers the following educational resources:

- Inner Circle Webinars

- News and Analysis

- Introduction to Forex

The Margin Call Podcast is a series of audio interviews in which trading professionals share their ideas, experiences, and advice on various trade-related issues.