- Only MetaTrader 4 is available

- Axi does not have a proprietary trading platform

- Crypto withdrawals are not available

- Axi restricts customers from the United States and other regions

Axi is a trading platform built by traders, for traders. With an emphasis on providing the best tools, tight spreads, and seamless execution, Axi caters to novice and experienced traders. The platform operates under full regulation from some of the world’s most trusted licensing authorities, ensuring transparency and trust for its clients.

Supported by a team of experts, Axi continuously strives to offer advanced trading features and exceptional customer service to give traders the competitive edge they need to succeed.

Axi Feature

| 🔎 Feature | 🥇 Axi |

| Regulation | ASIC,FCA,DFSA,VFSC |

| Country of Regulation | Australia,UK,UAE,New Zealand,Vanuatu |

| Suits Professionals | ✅Yes |

| Suits Active Traders | ✅Yes |

| Suits Beginners | ✅Yes |

| Most Notable Benefit | Low spreads on 100+trading instruments |

| Most Notable Disadvantages | Limited availabilityof some services in certain regions |

| Account Segregation | ✅Yes |

| Negative Balance Protection | ✅Yes |

| Investor Protection Schemes | ✅Yes |

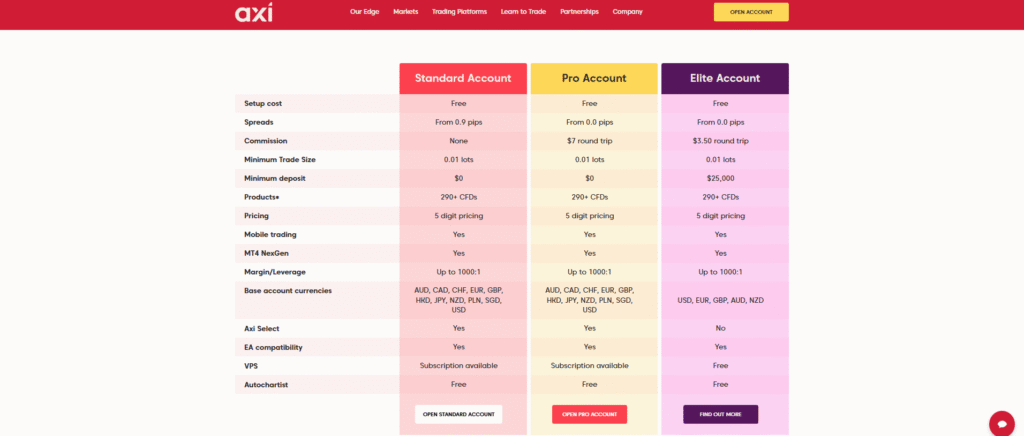

| Account Types | Standard, Pro, Elite |

| Institutional Accounts | ✅Yes |

| Managed Accounts | ✅Yes |

| Minor Account Currencies | Various |

| Minimum Deposit | $0 – $25,000 |

| Trading Conditions | Competitive spreads, no commission, options available |

| Fund Withdrawal Fee | Varies by method |

| Spreads From | 0.0 pips |

| Commissions | $7 round trip for Pro and Elite Accounts |

| Number of Base Currencies | 10+ |

| Swap Fees | Varies |

| Leverage | Up to 1:500 (varies by entity) |

| Margin Requirements | Varies |

| Islamic Account | ✅Yes |

| Demo Account | ✅Yes |

| VPS Hosting | ✅Yes |

| Total CFDs Offered | 100+ |

| CFD Stock Indices | ✅Yes |

| CFD Commodities | ✅Yes |

| CFD Shares | ✅Yes |

| Deposit Options | Credit/Debit Card,Neteller,PayPal,Skrill,Bank Transfer,Crypto |

| Withdrawal Options | Credit/Debit Card,Neteller,PayPal,Skrill,Bank Transfer,Crypto |

| Trading Platforms | MetaTrader 4,Axi Trading Platform(ATP) |

| OS Compatibility | Windows,iOS,Android |

| Forex Trading Tools | Advanced charting,automated trading tools |

| Customer Support | Responsive |

| Contact Number | Call Back Request |

| Social Media | Facebook,Instagram,X,YouTube,TikTok,LinkedIn |

| Languages Supported | Multiple |

| Educational Resources | Multiple |

| Forex Course | ✅Yes |

| Webinars | ✅Yes |

| Affiliate Program | ✅Yes |

| IB Program | ✅Yes |

| Sponsor Events or Teams | ✅Yes |

| Rebate Program | ✅Yes |

Safety and Security

Axi takes the safety and security of its traders seriously, operating under strict regulatory oversight from well-respected authorities such as ASIC, FCA, DFSA, and VFSC. These regulations ensure that Axi adheres to industry standards for transparency, fairness, and financial security.

The platform also provides account segregation, which ensures client funds are kept separate from company funds, offering an additional layer of protection. Axi employs robust security measures, including negative balance protection, ensuring traders cannot lose more than their initial deposit.

With these safeguards in place, traders can have peace of mind knowing their funds and personal information are secure while using the platform.

Minimum Deposit and Account Types

Axi offers two primary account types: the Standard Account and the Pro Account. Both accounts have a minimum deposit requirement of just $5, making them accessible for traders at all levels.

The Standard Account is designed for retail clients and offers competitive spreads starting from 0.9 pips, with no commission fees. The Pro Account, ideal for more active traders, offers spreads starting from 0.0 pips but does charge a $7 round-trip commission.

Both account types offer access to over 220 CFDs, mobile trading, and advanced tools such as MT4 NextGen, making them versatile options for traders with different strategies.

Trading Platforms and Software

MetaTrader 4 (MT4) is one of the most popular trading platforms for retail traders globally, offering ultimate flexibility and ease of use. With MT4, traders can access real-time pricing, advanced charting tools, and a range of trading products, including Forex, Commodities, Share CFDs, Indices, and Cryptocurrency CFDs.

Whether you trade from your PC, Mac, Android, or iPhone, MT4 ensures that you can monitor and modify your trades from anywhere. The platform also supports custom indicators, automated trading through Expert Advisors (EAs), and provides access to powerful tools like Autochartist for real-time market analysis.

Axi’s integration with MT4 allows traders to enjoy competitive spreads, no brokerage fees on standard accounts, and secure trading in a fully regulated environment.

Fees, Spreads, and, Commissions

Axi provides traders with transparent pricing and competitive spreads across its two main accounts: the Standard and Pro accounts. The Standard account offers spreads starting from 0.9 pips, with no commission, while the Pro account offers tighter spreads starting from 0.0 pips but charges a $7 round-trip commission.

Axi ensures that both account types provide access to advanced trading tools, including MT4 NextGen, EA compatibility, and Autochartist. Additionally, Axi’s funding options include low- or no-fee methods, allowing traders to keep more of their funds for trading.

These account structures and pricing are designed to suit various trading strategies and preferences.

Deposit and Withdrawal

Axi offers numerous local payment options from top global providers so traders can enjoy hassle-free and commission-free* deposits and withdrawals in their region.

Deposit Options Include:

- Credit/Debit Card

- Neteller

- PayPal

- Skrill

- Bank Transfer

- Crypto

Withdrawal Methods include:

- Credit/Debit Card

- Neteller

- PayPal

- Skrill

- Bank Transfer

- Crypto

Educational Resources

Axi offers the following educational resources:

- Video Courses

- eBooks

- Blog

- Axi Academy

Education and Research

Most of the research you would have to do is done by the Autochartist plugin and PsyQuation Premium tools. That is alright. If you need more tools to do your research, you can look through the market analysis section of the Axi website.

They post great content that included market commentaries that give traders all kinds of ideas on how to think about the trades. If you combine that with what is provided by the Autochartist plugin and the AI-based PsyQuation Premium tool, you end up with a package that can get you through most trades.

Even the education part is outsourced to the PsyQuation Premium platform that alerts you to mistakes while trying to make you a better trader. However, that is not all there is on Axi. If you want to learn more, you can access additional information.

Customer Service

There are three ways to get connected. You can use:

- Website live chat

- Telephone numbers

The live chat is the fastest way to get in touch with Axi representatives. The relevance of answers is all customers care about when dealing with customer service. You will be happy to know that they have the correct and full answers to your questions.

In addition to these methods, they also have a comprehensive FAQ section covering most of the common questions you may want answers to.

The best part is that the broker manages everything well that you won’t need support most of the time.

The only thing about the service that is a drawback is that they are only available 5 days a week.