- All fees and charges are displayed on the website, but the fee structure is a little complex.

- Not many funding options offered.

- Some complains about trade execution.

- No Crypto.

FxPro is an international online broker, with its headquarters in the City of London, and offices around the globe. The firm offers trading via CFDs, across several asset classes, including Forex, Shares, Futures and Spot Indices. The broker is fully authorized and regulated by the Financial Conduct Authority (FCA) in the UK, and also by other relevant authorities in the jurisdictions in which it operates. Company policy includes segregating all client funds, for top-level security. FxPro was voted the UK’s Most Trusted Forex Brand, 2017, by Global Brands Magazine.

FxPro Features

| Feature | FxPro |

| Minimum deposit: | $100 |

| Withdrawal fee amount: | None |

| Inactivity fee charged (Y/N): | N |

| Max leverage: | 1:30 |

| Spread from: | 0.6 pips |

| Number of instruments: | 2,100+ |

| Year founded: | 2006 |

| Time to open account: | 1 business day |

| Demo account provided (Y/N): | Y |

| Countries of regulation: | United Kingdom, Cyprus, |

FxPro Fees

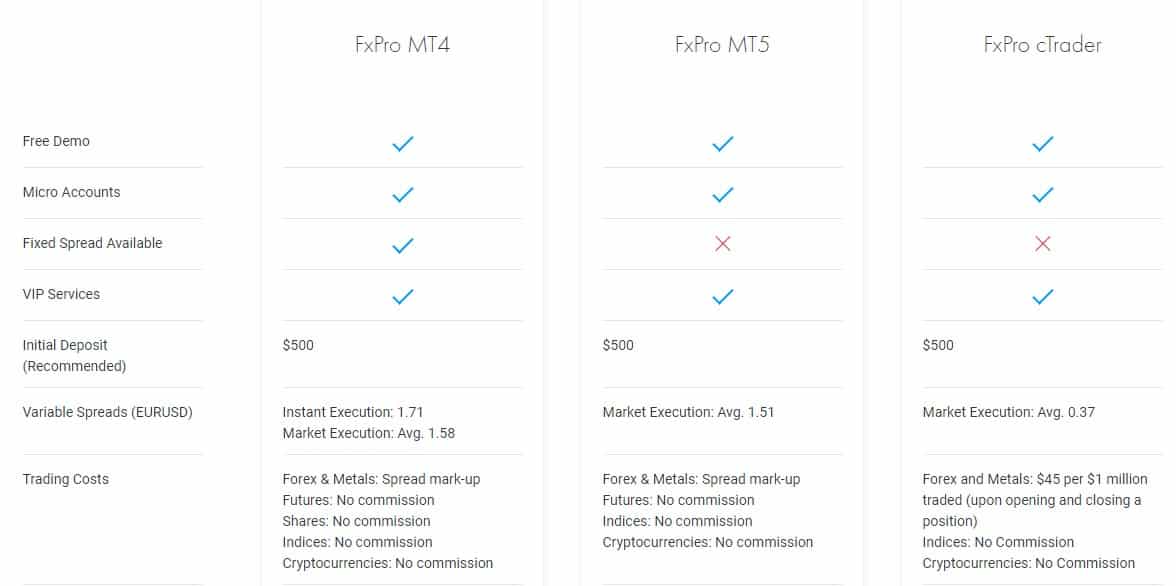

At FxPro, commissions and fees depend on the platform being used and the type of order execution, as well as the instrument being traded. The most competitive spreads are offered via the cTrader platform, which uses variable spreads, and for some asset classes, a combination of a commission and a variable spread. When trading via MT4 you can choose between fixed and variable spreads. Rollover charges are levied on trades kept open overnight. All fees and charges are displayed on the website, but the fee structure is a little complex, so it’s important to read through the information for the assets you are trading.

Trading Platforms

FxPro offers a choice of platforms, with the full suite of MetaTrader software available, allowing MT4 and MT5 traders to use the desktop, web-based, and mobile versions of their preferred MetaTrader platform. There is also the option to use the cTrader platform, which is growing in popularity, due to its user-friendly and versatile interface, and the ability to incorporate other trading applications, such as cAlgo, used to automate trading activities, and cMirror, which is a social copy trading application. Both MetaTrader and cTrader allow for the integration of a wide range of tools and indicators.

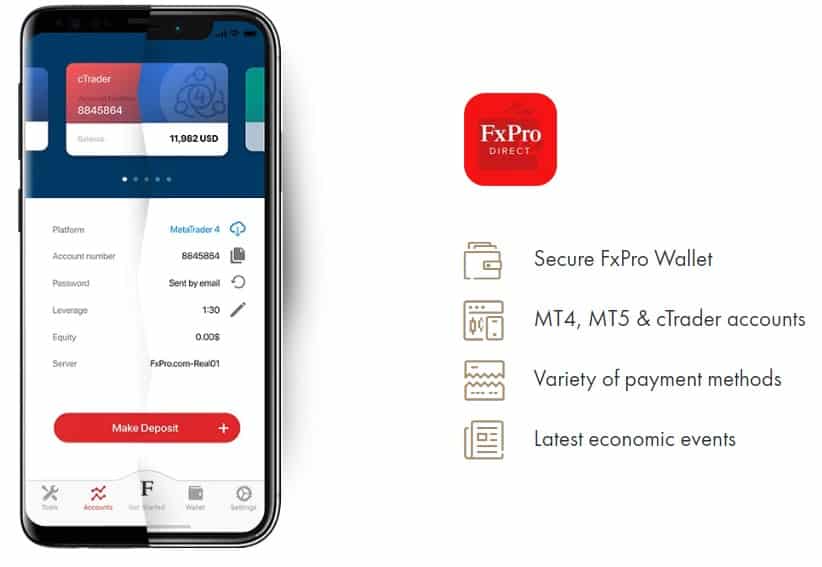

Mobile Trading App

Vantage provides traders with a thoughtfully chosen selection of trading instruments, granting them access to the most widely traded and liquid financial markets worldwide, ensuring optimal trading opportunities around the clock.

Commissions and Spreads

They have access to the interbank market, providing you with low spreads, access to more than 3,500 instruments that can all be used to trade. The FxPro spread, on average, is much lower. For example, the EUR/USD pair has an average spread of just 0.1 pips.

To access the live figures, access the website, and look at the spreads. A calculator will help you know how much you owe for the trades you make. On FxPro, commissions are only charged when you are trading forex pairs and spot metals. Even then, it does not apply to any other platform except for cTrader.

The charges per $1 million trades, stands at $45 at the time of writing this. If you pick an account where the base currency is not in USD, it will be converted to the alternative currency you choose.

Education and Research

On the FxPro official website, you will see at the top, an option that says ‘Tools’ and under that ‘Trading Tools.’ That is where you will find the education section. FxPro education provides you with access to online courses for beginners and advanced traders.

On the beginners’ section, the sections are divided into the following:

The basics

Fundamental analysis

Technical analysis

Psychology

In the Advanced traders’ section, there is additional content that covers Fundamental Analysis 2.0. Within this, you will find several topics that cover aspects of fundamental analysis that go deeper into the details.

Customer Service

Multi-lingual customer service is available 24 hours a day, 5 days a week, and can be accessed via phone, email or live chat. There is a dedicated global support phone line, run in English, as well as freephone numbers for many countries, including France, Germany and Russia. Email support is fast to respond and very helpful. Perhaps the most convenient form of support for most people will be the live chat option, easily accessed via the website.