- Complex desktop trading platform

- High options and margin fees

- No card deposit

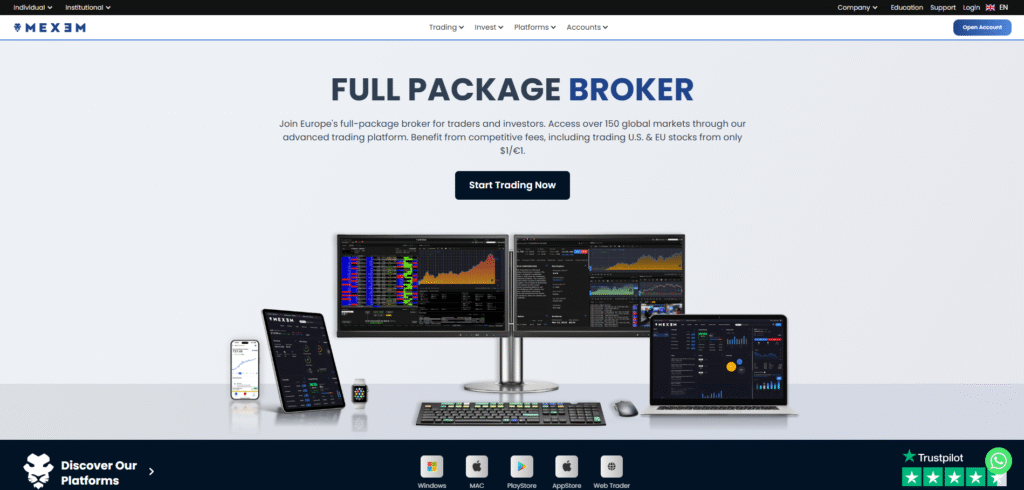

MEXEM is a Europe-based global stockbroker for traders and investors. It has low stock and ETF fees. Thanks to its link to Interactive Brokers, MEXEM covers a vast range of markets and products, and offers a multitude of great research tools on its sophisticated trading platforms. Additionally, it offers excellent customer service available in multiple languages.

However, there are some downsides: the desktop platform is complex, fees for options and margin trading are high, and card or Apple/Google Pay deposits aren’t supported.

MEXEM Feature

| Regulation | CySEC, FCA, AFM, FSMA |

| Account Types | Individual, Institutional Accounts |

| Trading Platforms | Client Portal, Desktop TWS, Mobile TWS, MEXEM Lite |

| Trading Instruments | Stocks, Bonds, ETFs, Options, Futures, Warrants, Mutual Funds, Forex, Metals |

| Minimum Deposit | €0.1 |

| E-mini and Standard Contract | $0.85 |

| Demo Account | Available |

| Account Base Currencies | EUR, USD, CHF, GBP |

| Trading Education | Educational Portal |

| Customer Support | 24/5 |

Fees

MEXEM’s trading fees for stocks/ETFs, bonds, mutual funds and futures are low, and there is no inactivity fee. However, forex, options and margin fees are high.We compared MEXEM’s fees with two similar brokers we selected, Saxo and DEGIRO. These competitors were selected based on objective factors like products offered, client profile, fee structure, etc. See a more detailed comparison of MEXEM alternatives.

Low stock and ETF commission

MEXEM US stock fees are less than half of the industry average. US stock fees are calculated as follows: $0.005 per share; min. $1, max. 2% of trade value

MEXEM also offers highly competitive stock trading fees on various local markets, including several in Europe, Asia and North America.

High margin rates

The USD margin rate fees at MEXEM is the highest among the brokers we reviewed. USD margin rate fees are calculated as follows: Fed Funds effective rate + markup

High options commission

MEXEM US stock index options fees are much higher than the industry average. US stock index options fees are calculated as follows: $2 per contract, min. $2.

No inactivity fee, no withdrawal fee

MEXEM does not charge any inactivity, account or deposit fees. The first withdrawal each month is free of charge, while subsequent withdrawals carry a fee. The fee depends on the currency and the method used for withdrawal, e.g. for EUR wire withdrawal it is €8.

Other commissions and fees

Low mutual fund commission: trading mutual funds involves the following charges: 0.1% per transaction, min. €5.

Low futures fees: US index futures fees are as follows: $1 per contract, min. $1.

High spot forex fees: MEXEM charges a forex commmission: 0.005% commission, min. $5. Spread costs come on top of this, e.g. the EURUSD spread is 0.1.

Low bond commission: US treasury bonds come with the following charges: 0.15% of trade value, with a minimum of $8.

Safety

MEXEM is a legit brokerage. It is an introducing broker to Interactive Brokers (IB), meaning that your assets and cash are held by IB’s Irish entity (IBIE), which is overseen by Ireland’s top-tier regulator. Also, IB is listed on a stock exchange and discloses its financials transparently.Deposit and withdrawal

MEXEM offers fast deposits and withdrawals, but you can’t use credit/debit cards or electronic wallets.Mobile app

MEXEM’s mobile trading platform offers a wide range of features within a user-friendly interface, but lacks price alerts.Desktop platform

MEXEM’s desktop platform Trader Workstation (TWS) comes with great customizability and advanced order execution. However, it’s not user-friendly and caters more to advanced traders.