- Low-cost and super-fast trading

- Lots of third-party trading signal services

- Strong regulatory framework

- Gets the most out of the MetaTrader platforms

- A relatively limited number of markets

- It doesn’t accept clients from the USA

The trading experience at Tickmill is high-grade. Execution is super-fast, cost-effective, and supported by a range of third-party add-ons which help traders identify trade entry and exit points.

The total number of markets on offer is less than on some other platforms, but the range of asset groups is wide enough and extends to bonds and cryptocurrencies. Fans of the MetaTrader suite of platforms will find both MT4 and MT5 are available, and Tickmill has set out to make the most of both of those dashboards.

Whether you’re trading their algorithmic models or looking to copy the ideas of others, Tickmill offers a way to get exposure to the markets. An additional nice-to-have feature is that the broker doesn’t apply any restrictions on what kind of strategies are applied. Hedging and Scalping are both possible and aided by the broker’s use of VPS systems.

Tickmill Features

| Feature | Tickmill |

| Minimum deposit: | $100 |

| Withdrawal fee amount: | None |

| Inactivity fee charged (Y/N): | N |

| Max leverage: | 1:500 |

| Spread from: | 0.0 pips |

| Number of instruments: | 180 |

| Year founded: | 2014 |

| Time to open account: | 1 business day |

| Demo account provided (Y/N): | Y |

| Countries of regulation: | United Kingdom, Cyprus, South Africa, Seychelles, Malaysia |

| Products offered: |

Fees

Tickmill has a strong reputation in the trading community for providing reliable and cost-effective trading. Its aggressive approach to pricing puts it in a strong position compared to its rivals, and the firm has followed that up by making it very easy to understand how costs work out. This level of transparency is a hallmark of firms that are confident about their position in the market and it makes it easier for clients to establish the risk-return on trades.

Spreads in the Pro Account start from 0.0 pips, with a typical spread on, for example, the AUD/USD of 0.4 pips. Where commission charges apply, they tend to be low in comparison with competitors. Spreads are variable, so they fluctuate according to market conditions displayed on the firm’s website. Tickmill charges a swap fee on all positions that are held open overnight. Each currency pair will have its swap charge, measured on a standard size of 1 lot. There are no deposit and withdrawal fees, and indeed the firm has almost no extra or ‘hidden’ fees beyond the stated trading fees, though they do say that they reserve the right to charge a maintenance fee on inactive accounts.

Trading Platforms

Tickmill offers the ever-popular MT4 and MT5 platforms. MT4 is the world’s most popular retail forex platform, and MT5 opens the door to trading some other asset groups. As MetaTrader users already know, the platforms offer a very intuitive and customisable interface, sophisticated features, excellent charting tools, and various technical indicators to suit almost any trading strategy. The platforms are available as downloadable and in the App format, which can be used on desktop and handheld devices. The ultimate backup is the WebTrader option which allows access to the market via any internet browser.

Mobile Trading App

The MT4 and MT5 platforms can be downloaded to Android and iOS devices. The Apps carry over a lot, if not quite all, of the functionality of the desktop versions of the platform; however, considering the abundance of tools and indicators found in the MetaTrader suite getting so many into handheld devices is to be welcomed.

The charting tools keep their surgical feel with the crisp aesthetics of MetaTrader platforms working well on a smaller screen.

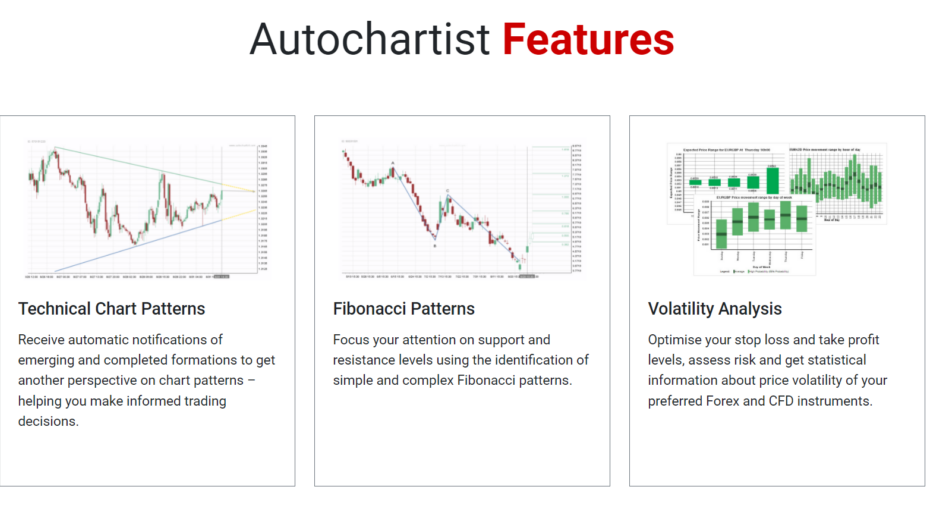

Market Research

There is a lot of additional research available to Tickmill clients, and all of it is focused on identifying trade entry and exit points and improving trading performance.The complete list of bolt-on trading tools is something of a wish list for those looking for direct support with trading. Tickmill clients can access, Myfxbook, Autochartist, Expert Advisors, Pelican Trading, forex calculators and an Advanced Trading Toolkit. Whether your desired strategy is based on copy trading, social trading or developing your own algorithms Tickmill have something to assist you.

More general research tools are also available. The broker offers webinars, seminars, eBooks, video tutorials, infographics, news articles and market insight reports. The resources are tailored to traders of all abilities, so they cater for beginner as well as advanced traders.

Ease of Use

The MetaTrader trading dashboards are a combination of easy user-functionality and powerful trading software. They have been in use for many years, which has allowed any glitches to be resolved and resulted in the finished product being just what traders need to access the markets.

It is a third-party platform, so registering with Tickmill is done in two stages. First with the broker, and then using that profile, with MetaTrader. This adds a small amount of time to the onboarding process.

The trading platforms can be hooked up to a variety of third-party packages. These complementary services include Expert Advisors, Autochartist, Pelican Trading and Myfxbook and the process of drawing on these nice-to-have features is seamless.