- No Negative Balance protection

- Slow Live Chat service

- No US citizens accepted

IC Markets is revered for its direct access to forex markets and ability to flow back raw spread arrangements to its retail traders. Its strength is reflected in three numbers: US$1 trillion monthly volume, 180,000+ active clients, With over 2,000 tradable assets, IC Markets offers something for everyone on its MT4, MT5, or cTrader trading platform configurations. Global markets are at your fingertips with the benefit of heavy regulatory oversight from ASIC, CySEC, the FSA in Seychelles, and the SCB in the Bahamas. It is difficult to find fault with this broker, a worthy choice for all.

IC Markets Features

| Feature | IC Markets |

| Minimum deposit: | $200 |

| Withdrawal fee amount: | None |

| Inactivity fee charged (Y/N): | N |

| Max leverage: | 1:500 |

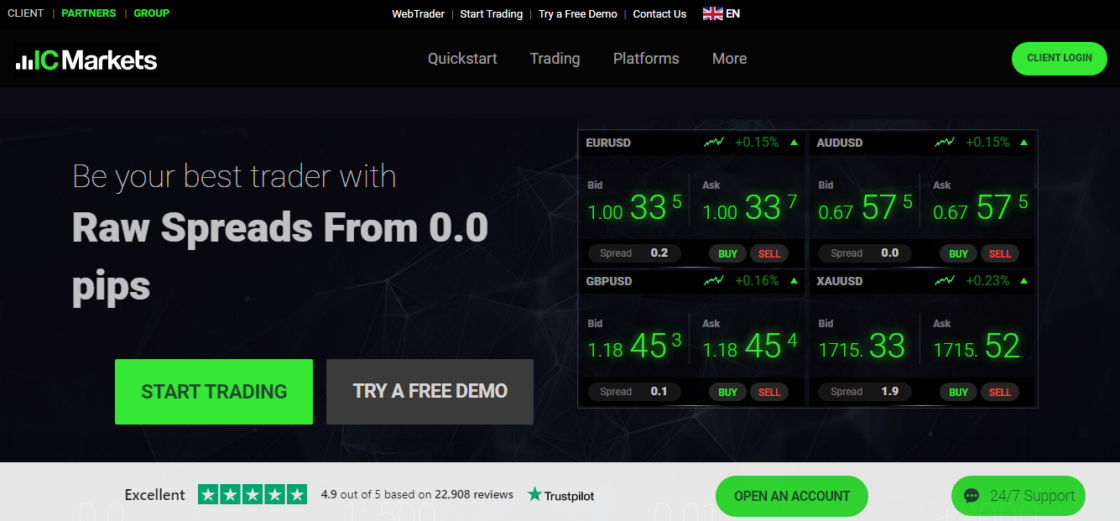

| Spread from: | 0.0 pip (EUR/USD average 0.1 pip) |

| Number of instruments: | 258 |

| Year founded: | 2007 |

| Time to open account: | 1-2 business days |

| Demo account provided (Y/N): | Y |

| Countries of regulation: | Australia, EEA (Cyprus), Seychelles, Bahamas |

| Products offered: | Forex pairs with CFDs for Stocks, Indices, Commodities, Bonds, Futures, and Cryptos. |

Who are IC Markets?

IC Markets was founded in 2007 by Andrew Budzinski, a local Australian businessman. It successfully gained its operating licence from the Australian Financial Control Service in 2009. From that point, the firm has recorded impressive growth statistics, culminating in its recent claim to be the largest online trading platform in the forex world by volume, touting a monthly trading volume of US$1.11 trillion.

The big draw for this firm is its direct access to liquidity providers and the pass-through of incredibly low raw spreads. These low spreads are packaged in an “institution-like” pricing model. A minimal commission is added to near zero spreads for forex pairs and CFDs for a host of assets, including stocks, indices, commodities, bonds, futures, and cryptos. The result is an optimum ECN-No-Dealing-Desk environment, which is also conducive to automated trading algorithms, one of the reasons why trading volumes are so elevated.

The firm has taken its focused approach globally with equal success. In addition to ASIC oversight, it also has licences from CySEC in Cyprus, which enables marketing across the European Economic Area. For other global clients, it has an office and registration from the FSA in Seychelles and complies with the SCB in the Bahamas. The Seychelles entity can offer leverage limits up to “1:500”, while its other operating entities comply with lower leverage levels mandated by ESMA and others over the past several years.

IC Markets Fees

The hallmark of IC Markets is its trading fee approach. Its distinguishing feature is the opportunity to enjoy raw spreads plus a small commission in the same fashion that a high-volume institutional trader might expect. The management, however, does not make acceptance of its innovative approach mandatory. Its Standard account comes with traditional pricing, which is relatively low and roughly equivalent to its other fee schemes. There are no non-trading fees in the form of hidden account fees or inactivity, deposit, or withdrawal fees. Still, payment intermediaries may exact a fee for their services. That is standard for all brokers.

Accounts/Membership Levels

There are three account categories with IC Markets. Its Standard account offers traditional account pricing without commissions, but effectively, the spread on a “EUR/USD” equates roughly to 0.6 pips, which is quite competitive in today’s market. The remaining two account categories are ECN related with a small commission and a raw spread. Those accounts are more suited for scalping, day trading, and automated trading strategies. One setup, a Raw Spread account, is for MetaTrader platforms and the other, also called a Raw Spread account, is for cTrader platform options. The latter option connects directly to London and permits “10X” more order positions.

There is a small commission attached to the cTrader option. All accounts have the same minimum deposit of US$200, counter to the industry practice requiring a larger deposit to access benefits. An Islamic account is also part of the mix. Opening an account is easy, straightforward, and fully automated and can have you up and trading in minutes. Just click on the “Open an Account” tab, clearly marked in green on each webpage and follow the prompts.

Deposit and Withdrawal

IC Markets excels in this category, providing convenience well above the industry standard. The firm offers no less than 15 funding options from global and regional payment processors. Be sure to check with your bank for the method that is the best financial fit for your purposes. IC Markets also supports ten different base currencies for account purposes, a benefit that few (if any) other brokers even come close to offering.

Payment methods include wire transfers, credit/debit cards, PayPay, Neteller, and Skrill, plus several regional services. Deposits are segregated in a major bank, and all payment data is encrypted for further protection using the latest SSL technology. Withdrawals are handled quickly from the Secure Client Area, and our deposit and withdrawal review revealed that no fees were assessed. Payment processors, however, may charge a fee for their services.

Trading Platforms

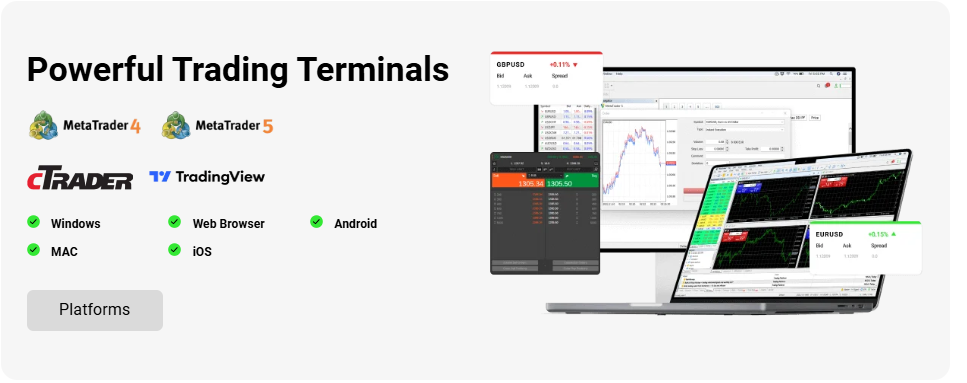

If you are the majority of forex traders who learned to trade on MetaTrader products, then you will not be disappointed by the trading platforms at IC Markets. The firm offers highly popular MT4 and MT5 software packages for desktop and mobile applications, a support network community, and social trading functionality. For the more discerning trader, the broker also supports cTrader, a product of Spotware Systems Ltd, and its mobile app for Android and iOS devices. This platform offers the additional insights provided by order books and liquidity providers, which tend to favour scalpers and high-volume day traders. Execution speeds average below 40 milliseconds. Free demos are standard for all platforms, and each environment supports copy trading. Scalping is also allowed for the ECN accounts.

Mobile Trading App

IC Markets supports mobile trading for each platform option – MT4, MT5, and cTrader. Each mobile app is available for Android and iOS users, and each supports a similar suite of charting tools and features as does its parent. The primary difference is that the mobile systems do not support algorithmic trading, which can be accommodated on the desktop versions. The same functionality exists for opening and closing positions, and each platform has access to social/copy trading features, whether from ZuluTrade, Myfxbook Auto Trade, or Signal Trader’s mirroring subsystem.

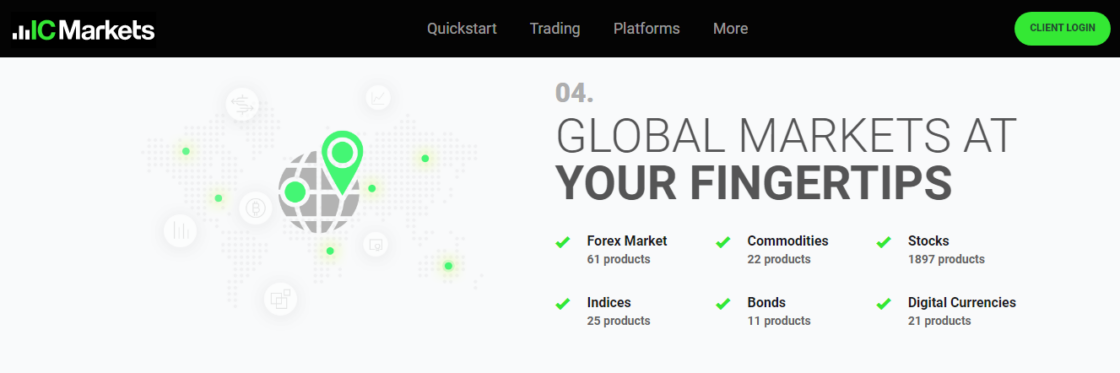

Markets and Products

IC Markets has chosen what it regards as the most popular and liquid of tradable assets from across the globe. Our forex reviewrevealed that the firm supports the trading of 61 foreign currency pairings in both the traditional way of trading as well as with CFDs. CFDs are also the vehicle for its selection of Stocks (1,897), Commodities (22), Indices (25), Bonds (11), and Cryptocurrencies (21). In total, there are over 2,000 possible trading scenarios, all at industry low-cost, competitive spreads.

Market Research

Low-cost brokers are typically criticised for taking shortcuts in the research area. Larger and better-capitalised brokers may make a significant effort in this area. Still, the industry trend is to allow the trader to gain insights from sources devoted to this practice. IC Markets, however, has tried to offer at least a minimum in this category, primarily via its blog and YouTube channel.

Customer Service

IC Markets receives high marks in Customer Service from its “24 x 7” phone and email support. If it falls short, it is around Live Chat. Most reviewers have found the service somewhat slow and not as effective as with some other brokers, but this could be due to volume overload. IC Markets is a high-volume shop that offers the most competitive spreads by holding staffing levels down. The employees get good ratings for being well trained and responsive.

Education

There is a rather voluminous knowledge centre that a beginner can study when time permits. There are videos, tutorials, and a broad mix of instructional materials related to trading, CFDs, and how its trading platforms work. The firm also has an impressive YouTube channel, which augments these website materials.

Safety

As with other global brokers, IC Markets delivers its services through an array of corporate entities, each registered in a specific local jurisdiction with regulatory oversight from the respective local regulator. These regulatory regimes include ASIC in Australia, CySEC in Cyprus and the EEA, the FSA in Seychelles, and SCB in the Bahamas. In all cases, client deposits are segregated in major banking accounts for protection, and the firm complies with Anti-Money Laundering statutes. The firm has also taken out a $1 million insurance policy to protect its clients from insolvency.

Alternatives to IC Markets

Our IC Markets review determined it is a major player in the forex and CFD broker market, especially in Australia. It is experienced, safe, and heavily regulated by Top Tier regulators. As formidable as this firm is, it still has competitors that compete at the same level of service. If their offering is not entirely to your liking, we can help you find a more appropriate broker for your trading style. The five firms listed below have proven track records and also compete on a global basis.